AMD’s Remarkable Transformation: Q4 2024 Marks New Era in Data Center AI

Advanced Micro Devices has delivered a breakthrough performance in Q4 2024, marking what can only be described as a transformative year for the semiconductor giant. The earnings report reveals significant strides in data center AI, market share gains, and robust financial performance that positions AMD for sustained growth.

Record-Breaking Financial Performance

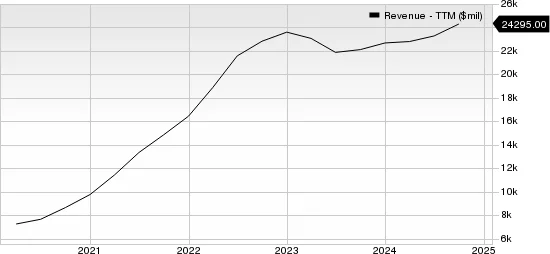

AMD reported impressive Q4 2024 results with revenue reaching $7.7 billion, representing a 24% year-over-year increase. The full-year revenue grew 14% to $25.8 billion, with net income climbing 26% and free cash flow more than doubling from 2023. These numbers underscore AMD’s successful execution of its strategic initiatives and growing market presence.

Data Center Dominance: The AI Revolution

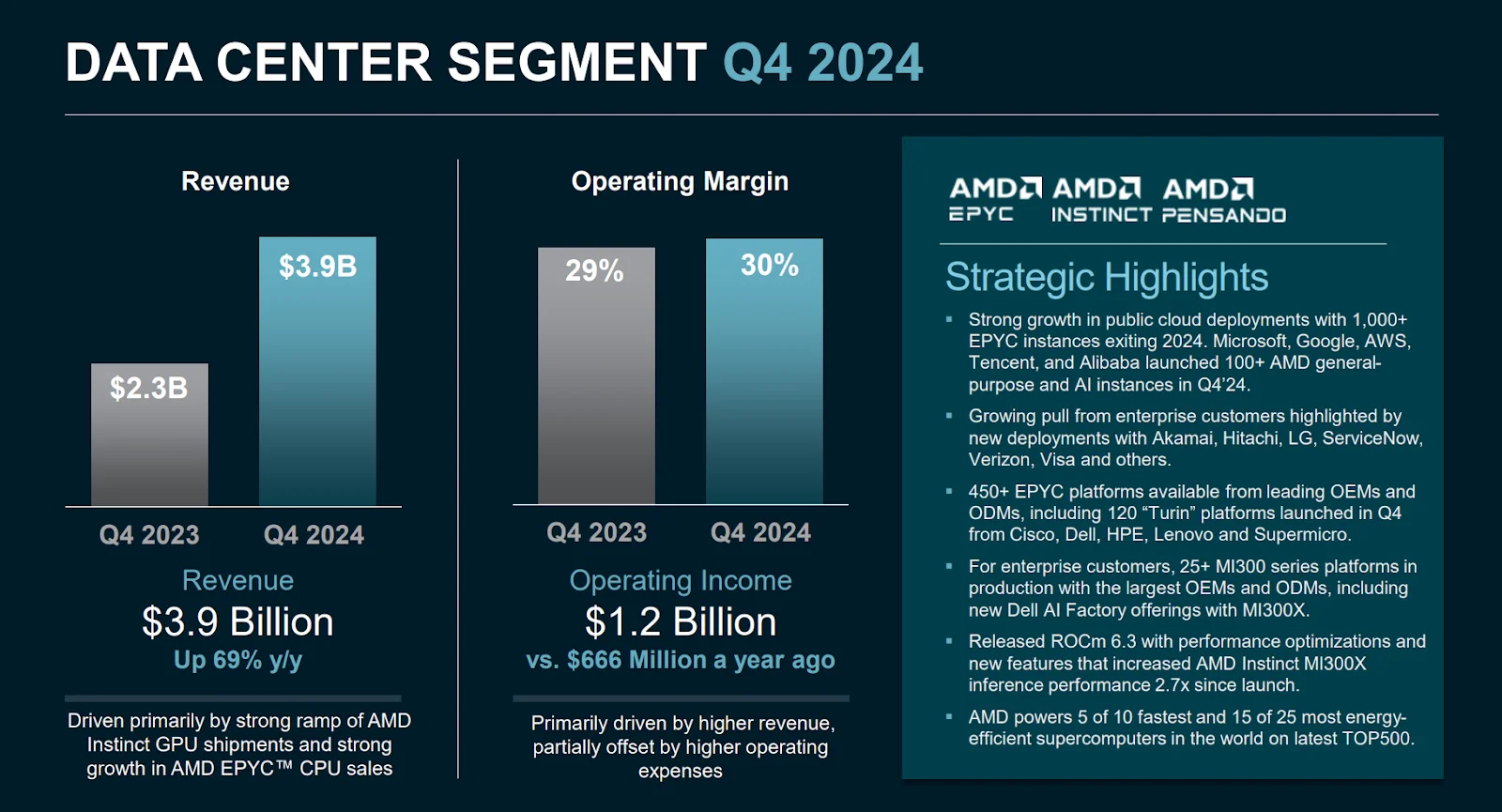

The data center segment emerged as the cornerstone of AMD’s success, contributing approximately 50% of annual revenue. Fourth quarter data center revenue surged 69% year-over-year to $3.9 billion, driven by several key factors:

The fifth-generation EPYC Turin processors demonstrated market leadership with over 540 performance records across industry benchmarks. AMD secured dominant positions with major hyperscale customers, achieving over 50% share with most of their largest clients. The public cloud presence expanded significantly, with AMD-powered instances increasing 27% to exceed 1,000 deployments.

Perhaps most notably, AMD’s data center AI business exceeded expectations, generating more than $5 billion in revenue for the year. The MI300X accelerator gained significant traction, with Meta exclusively using it for their Llama 405B frontier model and Microsoft deploying it for GPT-4-based Copilot services.

Client Segment Renaissance

The client segment showed remarkable recovery, posting record revenue of $2.3 billion, up 58% year-over-year. AMD achieved record desktop channel sell-out in multiple regions, dominating best-selling CPU lists globally with over 70% share at major retailers. The strategic collaboration with Dell marks a significant expansion into the commercial PC market, potentially opening new growth avenues.

Strategic Technology Advancements

AMD’s technological roadmap shows promising developments:

- The MI325X entered volume production with strong customer adoption

- Next-generation MI350 series featuring CDNA 4 architecture promises a 35x increase in AI compute performance

- MI400 series development progresses well, targeting leadership in rackscale solutions for 2026 launch

- ROCm software stack improvements delivered significant performance gains, with MI300X inferencing performance increasing 2.7x since launch

Market Challenges and Opportunities

While the gaming segment saw a 59% decline to $563 million and embedded segment dropped 13% to $923 million, these setbacks appear temporary. The gaming console inventory has normalized, suggesting a return to historical patterns in 2025. The embedded segment, despite mixed demand, secured record design wins worth $14 billion in 2024, up 25% year-over-year.

Forward Outlook and Strategic Positioning

AMD’s outlook for 2025 remains robust, with several catalysts for growth:

- Expected strong double-digit percentage revenue and EPS growth

- PC TAM projected to grow by mid-single-digit percentage

- Data center AI revenue expected to scale from $5 billion to tens of billions over coming years

- First quarter 2025 revenue guidance of approximately $7.1 billion, up 30% year-over-year

Investment Implications

AMD’s performance indicates a company successfully executing its strategic vision while capturing emerging opportunities in AI and data center markets. The combination of market share gains, technological leadership, and strong financial execution suggests AMD is well-positioned for sustained growth.

Key factors supporting long-term bullish outlook:

- Leadership in data center AI acceleration

- Strong CPU market share gains across segments

- Robust product roadmap with clear technological advantages

- Significant design win momentum in embedded markets

- Healthy balance sheet with strong cash flow generation

Market Impact Assessment

The semiconductor landscape is experiencing a significant shift, with AMD emerging as a formidable competitor in the AI computing space. The company’s success in securing major customers and delivering on technological promises suggests a potential reshaping of market dynamics in the coming years.

Concluding Thoughts

AMD’s Q4 2024 results demonstrate more than just financial success; they reveal a company successfully transforming itself into a comprehensive computing leader. With strong execution across product development, market expansion, and financial management, AMD appears well-positioned to capitalize on the growing demand for AI and high-performance computing solutions.

The combination of market share gains, technological leadership in key growth segments, and strong financial execution provides a solid foundation for continued success. As the AI computing market continues to expand, AMD’s strategic positioning and robust product roadmap suggest the company is entering a new phase of growth and market leadership.

Stay up to date!

Don’t miss out on valuable information we provide, Join our mailing list and stay up to date with weekly digest of exclusive contents that I don’t share anywhere else!

Join Atlantic Trading Community

Join the ever-growing trading community. A home where expert traders meet the power of technology to Analyse Stock Prices with AI to provide you Live Signals on the current market.